Legislative UpdatesEXTENSION OF DELIVERY APPROVAL FOR WHOLESALERS IN CONNECTICUT

STATE OF CONNECTICUT DEPARTMENT OF CONSUMER PROTECTION From the Office of John Suchy Division Director of Liquor Control October 3, 2017 FOR IMMEDIATE RELEASE Request for Extension of Delivery Approved by Liquor Control Commission All wholesalers in Connecticut have approval to deliver alcoholic liquor products (beer, wine, distilled spirits) which are ordered through October 31, 2017 through Friday, November 3, 2017. Please note that this is an approval for extension of deliveries only, and in no way changes the fact that order taking must be completed by October 31, 2017. In addition, please note that pursuant to section 30-6-A36 (a) of the Regulations of Connecticut State Agencies that "the period of credit shall be calculated as the time elapsing between the date of receipt of the merchandise by the purchaser and the date of full legal discharge of the purchaser through the payment of cash or its equivalent from all indebtedness arising from the transaction." FDA Food Code passage:

As you know, the CRA supported and was successful in the negotiating of specific language regarding adoption of the FDA Model Food Code. Adopting the FDA Model food code will drive much more consistency throughout the local health departments. The CRA is working with the Department of Public Health to summarize the differences between the current food code and the FDA Model food code to ensure so our members can easily comply with the new law and subsequent regulations. The FDA Food Code will be effective July 1, 2018. The Department’s Food Protection Program sent out a letter to all local health directors on June 23rd, which included an explanation of Section 10 of Public Act 17-93. Click here to see the letter in its entirety. We know many of you are interested in practicing sous vide. Because of the high interest the CRA was able to request a variance before the adoption of the FDA food code next year. If you are interested in practicing sous vide please see the link below that will bring you the variance request form. http://www.ct.gov/dph/cwp/view.asp?a=4748&q=563622&dphNav=| Class 2, 3, and 4 food establishments will need to continue to employ a certified food manager (formerly known in CT as a qualified food operator). They must possess a valid certificate from an approved testing organization. Please note that the CRA is an approved testing organization that holds ServSafe classes every Monday throughout the State at a discounted rate for our members. Click here for the ServSafe schedule or email Ashley at [email protected] for more information. 2017 Employment Law Update

Click Here to see the Updated Supplement to your Labor and Employment Handbook.

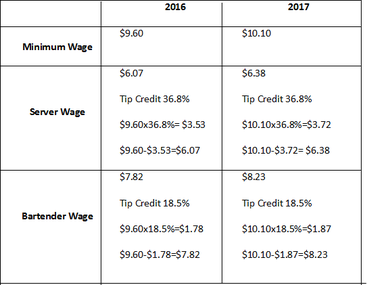

New Laws Effective January 1, 2017Increase in Connecticut's minimum, server and bartender wages effective January 1, 2017.

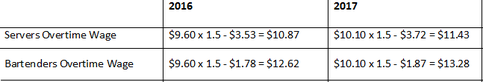

To ease the confusion with overtime rates please see the below chart that shows the overtime rates from 2016 vs 2017 for tipped employees.

Also going into effect on January 1, 2017 is PA 16-83, An Act Concerning Fair Chance Employment. This prohibits initial job applications from including a question about a potential employee’s possible criminal history. The law affirms that businesses are permitted to run background checks on a potential employee if state or federal law prohibits people with criminal background from being hired for a job.

Beginning on January 22, 2017, employers must only use the revised

Form I-9 version dated November 14, 2016. Overall, the revisions are designed to make it more user-friendly and easier to complete online. Some changes include:

New State Laws to Go Into Effect October 1, 2016

Several new laws will go into effect on Saturday, October 1, 2016. The following new laws directly impact the hospitality industry: Public Act 16-123 An Act Allowing Employers to Pay Wages Using Payroll Cards This act allows employers to pay their employees through payroll cards under certain conditions. An employee must voluntarily and expressly authorize, in writing or electronically, that he or she wishes to be paid with a card. The authorization must be free of any intimidation, coercion, or fear of discharge or reprisal by the employer. No employer can require payment through a card as a condition of employment or for receiving any benefits or other type of remuneration. In addition: employers must allow employees the option to be paid by check or through direct deposit, the card must be associated with an ATM network that ensures the availability of a substantial number of in-network ATMs in the state, employees must be able to make at least three free withdrawals per pay period, and none of the employer's costs for using payroll cards may be passed on to employees. Contact the CRA's Endorsed Payroll Provider - Datapay payroll to learn more about how they can do pay cards for your employees. Public Act 16-140 An Act Concerning Cash Refunds for Gift Card Balances This act requires someone: selling or issuing a gift card to give the buyer an electronic or paper proof of purchase or gift receipt and also requires sellers that accept a gift card as payment to give the purchaser, on request, cash for the remaining balance on the card after the purchase if the (a) balance is under $3 and (b) purchaser provides the proof of purchase or gift receipt. Public Act 16-169 An Act Concerning Unemployment Compensation Appeals and Hearings, Employee Pay Periods and Minor and Technical Revisions to the General Statutes Relating to the Labor Department This act makes numerous changes to the unemployment compensation statutes that generally give the Department of Labor (DOL) greater flexibility in processing unemployment claims and appeals. Among other things, it: allows DOL to deliver certain unemployment notices and decisions by means other than by mail (e. g. , email); starts the appeal period when the decision is “provided” to the party, rather than when it is mailed; and allows the labor commissioner to prescribe ways, other than a hearing, for employers and claimants to present evidence and testimony in certain unemployment proceedings. Please visit the CT General Assembly for a complete list. |

|